CLAIMS

CLAIMS underwriting

underwriting  Client Services

Client Services Finance

Finance Enterprise & Operational Risk Management

Enterprise & Operational Risk Management Claims

Claims

Resolution of Claims

Resolution of Claims

Wire Fraud

Wire Fraud

John B. McMillan

John B. McMillan

Giving Back to the Community

Giving Back to the Community

Our Claims Department always looks forward to providing outstanding service to our insureds. The attorneys in the department are all lawyers who were formerly in private practice. They are there for our insureds when things go wrong.

In reviewing our claims experience for 2019, increased claims severity was our primary concern. Across the board, insurance companies are experiencing a significant increase in severe losses with large firms. Here, the higher severity was driven by claims in general business litigation and general business commercial. Although claims severity increased in 2019, claims frequency remained steady. Residential real estate and plaintiff’s personal injury were the two practice areas in which we received the most claims in 2019, followed by family law and estates and trusts.

This year, the Claims Department looks forward to continuing to serve and be a resource for our insureds.

Of the claims closed in 2019, two-thirds of those files were closed with no payment. The remaining one-third of claims were resolved through settlement.

Having the wire fraud exclusion for residential real estate transactions on all policies significantly reduced wire fraud losses in 2019.

Claims Attorney Mark Scruggs was honored by receiving the North Carolina State Bar John B. McMillan Distinguished Service Award. This was a well-deserved award as Mark has dedicated his career to providing advice, service and mentoring to his fellow attorneys.

Numerous hours speaking throughout the state on various continuing legal education topics. They also served as officers or board members for state and local bar groups. The Claims Department works closely with Client Services to provide CLE courses, risk management advice and risk management alerts.

underwriting

underwriting

Reaching out

Reaching out

Working with our existing policyholders

Working with our existing policyholders

Stability and policyholder

Stability and policyholder

Enhancing our online

Enhancing our online

Protection that counts involves more than issuing a policy to a single policyholder. Protection that counts is providing stability to all our policyholders. The underwriting department maintains the Company’s stability for all policyholders by responsibly accepting risk and pricing the risk.

In order to do better, we have to stand out and interact. The Underwriting Department worked with Client Services to launch the LM Value Campaign to highlight the services that we provide our policyholders and the value of coverage with a mutual insurance company.

In 2019, we distributed surveys to a random selection of policyholders to see what we are doing well and what we can do better. One thing we learned: our insureds would like an online platform to improve their ability to conduct business with us.

We’re marketing the value of coverage with Lawyers Mutual to eligible lawyers practicing in North Carolina not currently insured with us.

In 2019, we insured more than 7,800 attorneys throughout North Carolina – and we took the responsibility of insuring them to heart. That is why Lawyers Mutual has been providing stability and financial protection from professional liability to attorneys for more than 40 years.

Our underwriters worked closely with lawyers to understand the risk associated with their practice, responsibly price the risk, and provide competitive premiums. As a result, we retained 91.4% of our policyholders.

We’re working to expand our insurer portal to include an online platform for applications and making changes to our insureds’ policies.

Client Services

Client Services

LM Value Campaign

LM Value Campaign

Put into Practice Newsletter

Put into Practice Newsletter

Byte of Prevention Blog

Byte of Prevention Blog

CLE Roadshow

CLE Roadshow

Our Client Services Team brings value to our policyholders every day.

From traveling across the state with the CLE Roadshow to generating alerts on developing legal trends to answering risk management questions by phone, we are responsive to the needs of our insureds and meet them in their communities. We guide them through the challenges of running a law practice in today’s complex world. We share our risk management expertise. We help keep them safe and successful.

In 2019, we placed special emphasis on digital marketing communications. Through platforms like LinkedIn, Twitter, Facebook and Instagram, our strategic messaging is reaching a new generation of lawyers in addition to our valued insureds.

For 2020, the Client Services Department looks forward to executing our mission of providing education and resources to help our insureds better serve their clients and the public.

We launched a social media campaign spotlighting the LM difference in service, resources and, most importantly, our people. Not only did our online engagement improve, our followers on major online platforms increased as well.

We delivered 12 newsletters filled with practice tips, news alerts and how-to articles straight to our insured’s email inboxes.

We published more than 160 original, informative posts on everything from wire fraud prevention to legal advertising ethics to Zoom conferencing.

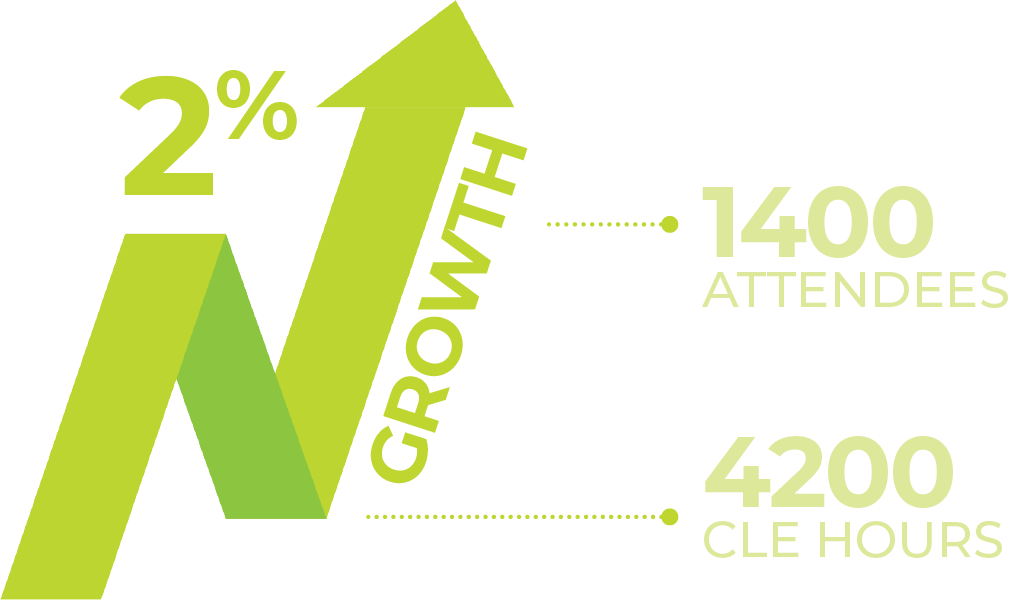

We provided expert risk management content and tech training to a total of 1400 attendees, resulting in 4200 CLE hours. At a time where attorneys can opt for online CLE hours, our live, in-person attendance grew by 2%.

FINANCE

FINANCE

Went Paperless

Went Paperless

Reconfiguration

Reconfiguration

Investment Income

Investment Income

Financial Results

Financial Results

Our Accounting and Finance Team strives to make efficient use of policyholders’ premiums and to timely administer claims payments when needed. When prudent, and with the Board of Directors declaration, it is the Accounting team’s pleasure to return funds to policyholders in the form of policyholder dividends.

Going forward, the Accounting and Finance Team will continue to fulfill the daily requirements of cash disbursements, receipts, tax returns, supplying analytical analysis and financial statements while always looking for better more efficient ways to accomplish them.

We converted years of paper documents to bits and bytes in preparation of Lawyers Mutual’s office move.

We coordinated with the company’s enterprise software experts to increase paperless processing of vendor payables. We also set up employee payroll & benefit services for the Company’s growing subsidiary, LM Title Agency.

We have focused on investment income over the past years and have been able to maintain income levels even in a low rate environment. This is important to providing other cash sources to pay claims and related expenses of maintaining insureds policies.

Total admitted assets topped $124 million at year end. Policyholder Surplus rose to $93.2 million, an increase of 7.4%, keeping pace with claims inflation, economic risks and other potential risks within investments markets. The strong investment gains and distributions from subsidiaries provided sufficient growth in policyholders’ surplus to keep pace with the changing environment as well as to return a portion of surplus to our insureds in the form of a 3.0% policyholder dividend.

ENTERPRISE AND OPERATIONAL RISK MANAGEMENT

ENTERPRISE AND OPERATIONAL RISK MANAGEMENT

LML Office Move

LML Office Move

Business Analytics

Business Analytics

Cybersecurity Without

Cybersecurity Without

Our Enterprise and Operational Risk Management Team operates largely in the background with tasks such as maintaining the technology and security programs, supporting other departments through business analytics, and developing and testing policies and procedures to maintain operations through unexpected events.

In 2018 we focused on presenting information in newsletters, blogs, and CLEs about the emerging cybersecurity threats faced by law firms. Building on that during the past year we presented additional programs about how to begin addressing cybersecurity and decrease your potential for becoming a victim – all without spending a lot of money.

By continuing these discussions together, we create a culture of security and preparedness - giving us all protection that counts.

Employees packed up their desks on a Thursday evening and we spent the weekend ensuring they could walk in the new office location Monday morning and continue serving you, our insureds, with little or no disruption.

Our team grew with the addition of a dedicated business/data analyst to provide improved reporting capabilities to Lawyers Mutual’s various departments.

We created a new CLE program and took it on the road! This popular program provides tips of how to get started on your own journey to being more secure. If you missed it, the manuscript is still available on our website as part of the 2019-2020 Put Into Practice program (https://www.lawyersmutualnc.com/risk-management-resources/manuscripts).